Over the years, financial inclusion efforts in emerging economies have predominantly been about expanding the access and usage of formal financial services, to improve the quality of life of people in low-income segments. Sub Saharan Africa has been a trailblazer in the use of technology to bring financial services to people who still have no financial accounts. Although also facing some challenges that may be hindering development in the region.

According to the Global Findex database(1), 515 million adults worldwide opened an account (at a financial institution or through a mobile money provider) between 2014 and 2017. This means that 69% of adults now have an account, up from 62% in 2014. Account penetration is at 94% and 63% of adults in developed and emerging economies respectively.

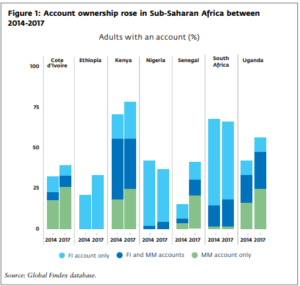

Account ownership in some Sub-Saharan African countries between 2014 and 2017

GSMA’s 2019 State of the Industry Report on Mobile Money(2) highlights that in Sub-Saharan Africa. There was an increase in 50 million new mobile money accounts in 2019. And that this region remains at the epicenter of the mobile money global movement. With digital transactions representing the majority – 57% of mobile money interactions. And more value is circulating in the mobile money system than ever before. The report also forecasts that account adoption across Sub-Saharan Africa will remain strong and the region will surpass the half-billion mark by the end of 2020.

So far this is impressive, but is it enough?

From these figures, the progress in access to finance seems remarkable, thanks to digital financial services. However, active usage of financial services remains very low, and today’s leading financial inclusion challenge. From the Global Findex database, about one in five account owners has an account that is currently inactive. Without any form of transactions within the past year, while about two-thirds of the global mobile money accounts are dormant. The implication here is that the commercial viability of digital financial services is questionable and many financial service providers may struggle to achieve scale, where profitability is attainable. This also means a struggle to improve the quality of life of people in low-income segments, considering the financial inclusion objectives.

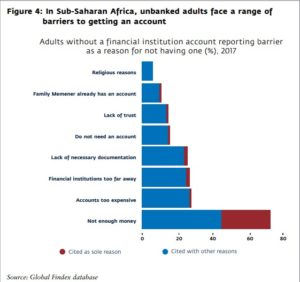

Although increased usage of accounts is important, account dormancy is not a problem to people in the low-income

segments because living on very low income levels forces them to opt-out from services that are perceived to be expensive and not suited to their needs. A significant number of people in Sub-Saharan Africa (about 340 million adults) still have no accounts at financial institutions. 3 in 4 of these unbanked adults say they have too little money for account ownership according to the Global Findex study(3), and almost 30% cite lack of funds as the sole reason for not having an account. So, how can financial inclusion improve their quality of life? Does greater usage mean greater impact?

The impact of financial inclusion is debatable. There have been several studies that have shown how financial inclusion improves lives. However, these studies tended to focus on the impact of single use cases, e.g. microcredit, resulting in the industry being product-focused. Improved lives cannot directly be achieved from only owning and using accounts, but through the ability to be resilient and financially healthy.

Rethinking financial inclusion: From the linear narrative of access, usage and impact, to resilience and financial health

We all now have the understanding that the usage of financial services does not always equate to positive impact(4) , and that increasingly, customer needs are to be at the core of all efforts for driving commercially viable financial inclusion. So, to be successful and impactful, the industry needs to shift away from the product-focused approach to consider other essential variables like building financial knowledge and aligning with behavior, robust infrastructure and ecosystems, etc. that enable the customers’ journeys to build resilience and financial health.

Building the resilience of people refers to how financial services allow them to prepare and deal with shocks when they occur and recover. Financial health refers to opportunities for individuals to improve their livelihoods through access and usage of relevant financial services. The resilience and financial health outcomes constitute the empowerment necessary for the impact of financial services.

Financial Resources

This empowerment is fueled by financial resources (assets and liabilities), human capability (skills and ability) and physical capability (physical mobility and health. (5) Finding the best approaches to improving the lives of people therefore involves the development of these three catalysts as in the below examples derived from the CGAP theory of change for impact and evidence:

Financial Resources (Assets and Liabilities)

• Fostering the growth of entrepreneurial ecosystems and income stability. For example through favourable policies that encourage growth across all industry sectors. It improved access to credit leveraging digital financial services

• Leveraging digital financial services to support the MSMEs for instance through exploring innovative and alternative financing options

Human Capability (Skills and Ability)

• The use of financial services/ investments to improve access to skills development.

• Use of government subsidies to facilitate more innovation and risk-taking in financing education and skills development

Physical Capability (Mobility and Health)

• Facilitating financial access to health and WASH i.e. water, sanitation, and hygiene, etc.

• Government-led approaches to expanding the reach of WASH services

Exploring ‘true financial inclusion’

There are immense opportunities to explore linkages between digital financial services and other sectors. Spreading digitisation, and enabling usage through financial tools such as payments, beyond the financial services industry. This calls for collaborations across sectors and stakeholders to leverage technology for cost-friendly business models, exploring and expanding the use cases for the unbanked and underbanked. By so doing, a lot can be achieved in terms of achieving ‘true financial inclusion’ for improved lives.

1)The Global Findex Database 2017. Measuring Financial Inclusion and the Fintech Revolution

2) State of the Industry Report on Mobile Money 2019

4)How Useful Is “Usage” in Measuring Financial Inclusion’s Impact? CGAP, 2019