Financial regulation needs to keep in pace with rapidly evolving innovations in the financial sector, whilst aligning them with their mandates. This can be a particularly daunting task for financial regulators. As they may have two significant limitations: limited staff resources available to focus on a given topical area and limited capability, i.e., limited technical background, skills and expertise to make appropriate decisions across a variety of regulatory domains. The Covid-19 pandemic has significantly highlighted how these limitations hamper the ability of regulation to be an enabler for market development and innovation. However, due to Covid-19 restrictions, there has been an increase in uptake of online training. Which seeks to increase the capacity building of policymakers, regulators and supervisors.

Can capacity building inform regulatory change? Financial authorities play a leading role in increasing financial inclusion globally. However, the lack of capacity to and implement enhanced and forward-looking policy and regulation is often cited as a key challenge that hampers the goal of global financial inclusion. It is important for financial authorities, such as policymakers, regulators and supervisors, to continuously identify their changing capacity-building needs that are specific to their context.

The pace of progress towards regulatory change and regulatory flexibility isn’t keeping in step with innovation. Several capacity-building trainings offered by a variety of actors, including Digital Frontiers Institute (DFI) generally work complementarily. However, despite these efforts, there continues to be a divergence in the type of capacity-building training. That is supplied as opposed to the training that are needed by financial authorities. Consequently, these opportunities are not tailored to policymakers’ context and needs1. To bridge this gap, it is key for capacity-building providers to understand their desired student persona. And their context to offer tailored trainings that can encourage an increased pace of policy and regulatory change. Which provides policymakers and regulators with some level of discretion, thereby making these changes flexible and agile to future developments in the industry.

Regulating for innovation is a multi-faceted and multi-stakeholder endeavour. Financial policies and regulations are key enablers for inclusive digital financial services. Recent innovations include (1 Dalberg Advisors (2019), CGAP Insights: How do policy makers learn and adapt today?, available here.) new business models, products and technologies, which have the potential to encourage more people to use formal financial services2. New business models include digital credit, crowdfunding, peer-to-peer lending and insurance. When considering how and if to license these new business models. For that financial authorities need to identify, understand and prioritize the key risks and opportunities these bring to their jurisdiction. New products such as instant payments, stable coins and central bank digital currencies (CBDCs) have significant implications on legal and regulatory frameworks of jurisdictions as well as risks to their monetary sovereignty. Finally, new technologies may be the underlying foundation of the new business models and products, these include cloud computing, application programming interfaces (APIs), digital identity, distributed ledger technologies and big data analytics.

These innovations raise a lot of questions for policymakers and regulators, which ultimately inform their decisions. A lack of technical capability amongst policymakers and regulators often results in the absence of clear, enabling legal and regulatory frameworks, which is a barrier for financial innovation. This lack of regulatory clarity can be addressed, initially, by equipping regulators with the technical knowledge, which addresses their questions and helps them to develop prudential policies and regulations as well as use innovation facilitators that are relevant to their context. Furthermore, policymakers and regulators need to understand how to implement the tools that they have at their disposal appropriately for their jurisdiction.

Capacity-building is the key to unlocking enhanced and advanced regulatory change. However, for capacity-building initiatives to achieve this desired outcome, they need to incorporate accountability frameworks into their participation selection criteria. Furthermore, capacity-building providers can provide scholarships. They can ensure consistent coordination between participants across different jurisdictions. But coordination with other capacity-building providers and development agencies as well. Digital Frontiers Institute provides scholarships and has established Communities of Practice (CoPs). Which will ensure that learning continues outside of the online classroom through facilitating effective stakeholder coordination. It also collaboration nationally, regionally and internationally.

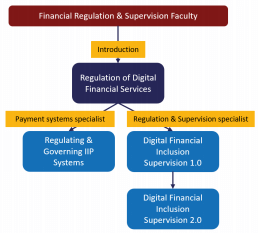

Through DFI policymakers and regulators can follow one of these journeys according to their focus area in their institution. DFI seeks to increase technical capability of policymakers, regulators and supervisors. Such that they understand the new developments in industry, identify and understand the key risks and opportunities of innovations. Understanding and appropriately using the tools at their disposal as well. A sound understanding of emerging approaches, through increased technical capability. It can help supervisors maximise their limited resources thereby enabling enhanced and forward-looking regulatory change.