Technology innovation and digitisation of banking services have created opportunities for new players in financial payments to emerge. It has also catalysed the emergence of real-time payment platforms which underpins a ‘real-time economy’ and ‘closed cross-border ecosystems’.

In today’s world, moving money in real-time has become the global de facto method for payments; not only for P2P or P2B or B2P or B2B via a bank’s network, but with alternative Payment Service Providers (PSPs). Payment systems like Zelle and Venmo provide real-time payment services that enable instant money transfer within seconds between consumers on the same network. These systems work efficiently in-country but they are often mis-aligned with national real-time payments strategy as we have witnessed in countries like India (Unified Payment Interface of- NPCI) and Australia’s New Payments Platform (NPP). Just as we have seen this evolution happening in other sectors of the global economy, the inclusion of mobile network operators, fintechs and big tech firms as participants in Africa’s banking ecosystem has contributed immensely to the continent’s payments revolution.

Despite global recognition of payments innovation in Africa with two leading countries in Sub-Saharan Africa with ground-breaking real-time payment systems implementation, the narrative around modernisation of national real-time payments systems is fraught with illusions.

What do I mean by this?

For many years, through the aegis of government-backed acts, central banks in Sub-Saharan Africa have assumed a pivotal role in the modernisation and transformation of payments; creating safe, affordable, accessible, secured, reliable and efficient national payments systems that facilitate poverty reduction, expand financial inclusion, foster development and support the financial stability of a country (World Bank Payment System Report, 2020). While some countries with the Central Bank-led model have witnessed a high quantum of success, some countries with the bank coalition model have also witnessed varying degrees of success and failures. These two scenarios are contexts prevalent in the top three fintech hubs in Africa championing modernised real-time payments services.

What has revolutionised payments in African markets?

It will be incorrect to assume that central banks drive all national payment systems in African countries (I stand to be corrected). Payments system experts have opined that Africa has a different landscape considering the mix of a central bank’s led strategy execution by proxy (as seen with NIBSS in Nigeria and BankServe in South Africa) and direct regulation of payment innovations (like the case of Safaricom Mpesa in Kenya directly regulated by the central bank of Kenya) used to drive national payments and financial inclusion agenda. However, with banks playing a dominant role in driving the cashless Africa prospect and controlling its payments transformation and modernisation initiatives, the continent’s top telecoms operators have also become a force to reckon with, thanks to their “mobile money” networks making them gatekeepers to the Fintech revolution.

In addition, the low cost of smartphones and feature phones has led to the leapfrogging of technology and internet penetration, resulting in an explosion of fintechs targeting Africa’s emerging markets. Because of these capabilities, telcos have successfully developed real-time payment platforms and built sustainable agent networks which facilitate multiple streams of income and are relatively close to all consumers. A popular success story is M-Pesa in Kenya, developed by Vodacom with tangible contributions from great minds from Cambridge University.

Let me provide some statistical insights.

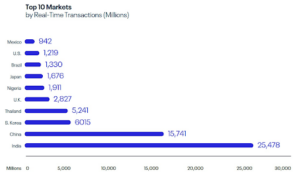

In the ACI Worldwide report on global real-time payments for 2021, Nigeria ranked 6th in daily real-time inter-bank transactions in the world, thanks to the NIBSS Instant Payment (NIP) system which facilitates A2A-Wallet payments. The Nigeria Interbank Settlement System Plc (NIBSS) is owned by banks but executes a central bank-led national payments modernisation agenda by proxy.

Kenya was ranked amongst countries with potential growth for real-time payments by ACI Worldwide in March 2021. M-Pesa provides a real-time mobile wallet/payment platform with intra-system daily transactions in Kenya, similar to Nigeria’s NIP.

The real-time payment platform (PesaLink) operated by the Kenya Bankers Association also contributed to this ranking.

However, given the usage of a real-time mobile/wallet payment platform in a country having the same transaction trend as NIP, why was Kenya categorised as a growth market for real-time payments? Could it be because the Central Bank of Kenya doesn’t directly influence PesaLink’s operations to make it the de facto national payment platform? All these could be pointers as to why Kenya is seen as ‘late to the party’ in implementing a real-time payment platform that drives national payments agenda. Nonetheless, Kenya’s success story for Mpesa’s real-time mobile payment service is globally recognised for its innovation.

Are the real-time payments modernisation in Africa relevant in a global context?

The answer is both a yes and a no. However, my contribution to varying degrees of thoughts will focus more on contexts peculiar to Nigeria, South Africa and Kenya.

In Nigeria, the NIBSS Instant Payment (NIP) system currently offers instant interbank A2A-Wallet payments. While this payment system is real-time and globally recognised, it still operates an open-loop system running on proprietary XML messaging which isn’t of global standard, and doesn’t offer cross-border payment options.

In South Africa, BankservAfrica (also known as the South African Bankers Services Company Proprietary Limited) is the national payments platform that offers real-time A2A interbank payments. It is powered by the Real-Time Clearing (RTC) mechanism that still runs on the ISO 8583 format.

In February 2021, Tata Consultancy Services (TCS) announced that TCS BaNCS™ has been selected by South Africa’s BankservAfrica to drive the Rapid Payments Program (RPP) and introduce a real-time retail payments system. Although yet to be released, the same announcement stated that the new payment rails will have complete support for ISO 20022 messaging format.

Based on information currently available to the general public, BankServ aspires to facilitate cross-border payments in SADC using these new payment rails. However, the release of TCS BaNCS™ will reveal how expansive the capacity of real-time payments in South Africa has been upgraded.

Safaricom’s M-Pesa and IPSL’s PesaLink are the national platforms that provide real-time payment services in Kenya. M-Pesa’s wallet-to-wallet system is predominantly used for intra-network transactions, and offers cross-border payment options to a list of African countries (having shutdown operations in India and Eastern-Europe).

PesaLink recently launched a modernised real-time payment system based on the new global messaging standard- ISO 20022, placing Kenya on the global map of modernised real-time payments adopters on the continent, ahead of Nigeria and South Africa.

IPSL achieved this milestone by applying the five pillars of real-time payments modernisation. These pillars include alignment with global messaging standards, open-loop system (A2A-Wallet) capability, catalyst for digital transformation across banks, support for open banking and open APIs agnostic.

Besides inter-bank payments, it is currently enabling payments to telcos on the ISO 20022 messaging standard – a first in Africa.

Conclusion

Banks can no longer keep up with the current pace of change in banking while using payments systems that were deployed in the 1980s. It is a known fact that systems that were designed for cards, point of sale, and ATMs are not dependable in a non-physical world. While there is still time to counter the competitive threats, incumbent banks around the world should act with urgency to protect their advantages, which are under direct attack by these new providers. They must also build new business models capable of satisfying today’s consumer needs and evolve to meet future needs and catch up with market developments.

We can say that the rapid modernisation of real-time payments in Africa, following the developments in her top three fintech hubs, was because of the successful implementation of various local payments use cases, active regulatory involvement, mobile payment innovations and successful bank-led initiatives.

Countries looking to modernise their national real-time payment system(s) should look inwards and ensure that they implement the local use cases for payments to meet the needs of stakeholders. Activities of regulatory bodies like central banks need to be at the same pace as market developments, where modernisation initiatives were executed in alliance with banks and payment service providers, in a way that gives them ownership.

For countries that are struggling to improve interoperability among payment service providers, execution of strategic moves like real-time payment modernisation can do without central bank-led direct or proxy initiatives.

Implementation and modernisation of nationally enabled real-time payment systems are of different constructs, and any country seeking to achieve it needs to know that there is no ‘one-size-fits-all’ strategy. They need to take into consideration their unique national contexts while contemplating the pointers I have shared.